How smart, innovative and future-ready are our roofing solutions? The results of our 2020 Australian Roofing Survey are now in.

Who took part in the survey?

Survey respondents came from a number of occupations, including roofers, architects, builders, manufacturers, business owners and employees. Retirees and homeowners were also included in the survey.

The vast majority of respondents were located in NSW (49%), followed by Victoria (25%) and QLD (10%). There were also representatives from the other states and territories (except for NT).

When it came to business size, most respondents worked in a business that had between 1 and 10 employees (48%), followed by 10 – 50 employees (24%). 17% of respondents worked in a business with over 100 employees.

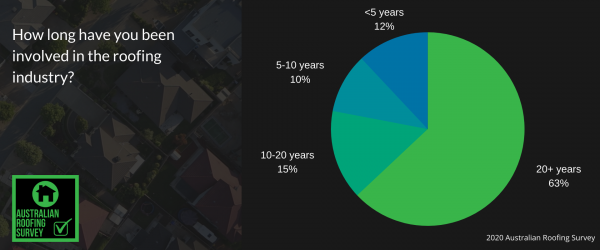

Longevity in the roofing industry was evident, with 63% having been involved in the industry for 20+ years. 15% had been involved for 10 – 20 years, 10% between 5 and 10 years, and the remaining 12% less than 5 years.

Common roofing work and materials

In relation to the nature of roofing work, the vast majority worked on residential (47%), or a mix of residential and commercial (40%). While the focus of this work was primarily on new builds (35%) or renovations (25%) or both, other work included supplying roofing or plumbing supplies and accessories, product research, repairs and maintenance and property development.

The most common roofing material used amongst respondents was Colorbond/metal (58%), followed by tile (33%), including terracotta, ceramic and concrete. Other respondents worked with both materials, flashing or insulated panels.

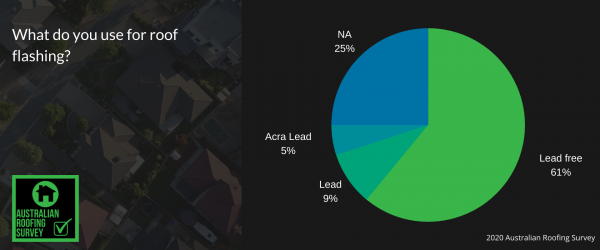

Lead-free flashing was the most commonly used flashing product (61%), followed by lead flashing (9%) and Acra lead (5%).

Most roofing materials were being sourced from independent stores or national chain stores (22% each). State based groups (17%) or online (5%) were also nominated as sources of roofing materials, along with buying direct from manufacturers/suppliers, or from the builders themselves.

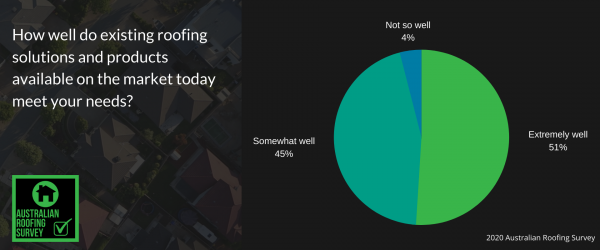

Satisfaction with existing roofing solutions

Thankfully, today’s roofing solutions and products appear to meet the needs of the majority of respondents. 51% felt that their needs were met ‘Extremely well’, while 45% considered that their needs were met ‘Somewhat well’. Of the 4% of respondents whose needs were not being met, the reasons included:

- There are many cowboys in the roofing business and finding the right people that use quality materials who know what they are doing can be difficult

- Better integration of solar needed

- Generally, most roofing systems are two dimensional and don’t cope well with turning corners, flashing and waterproofing.

How roofing products are chosen

Survey respondents were asked to rate which factors were the most important when choosing roofing products – cost, quality, environment/sustainability or Australian made – in order of importance from 1 to 4. Overall, quality ranked highest, with 67% considering this as the number one priority. This was followed by cost, with 47% ranking this as second in importance. Environment/sustainability and Australian made were evenly split across positions 3 and 4. It’s clear from these results that quality is the most important consideration when selecting roofing products.

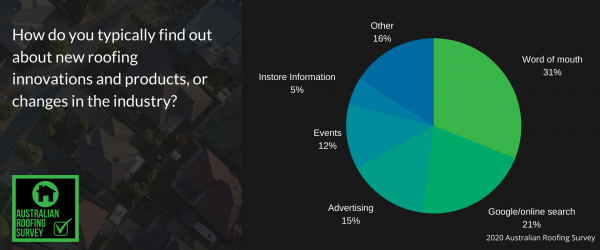

Staying on top of the latest changes

In an industry that experiences frequent change, it’s important for those involved in it to stay on top of new products and innovations. And the most common method of doing this? Word of mouth, as 31% of respondents indicated. This was followed by Google/online search (21%), advertising (15%), events (12%) and instore information (5%). Other responses included suppliers, builders’ associations, emails, brand representatives, insurance and industry publications, indicating that information was being received from a number of different sources, both online and offline.

When asked who the most innovative or progressive roofing company in Australia is, there was a variety of responses. CSR Monier took the lead at 31%, while Bristile, Boral, BlueScope, Stramit, Evo Building Products, Revolution Roofing, MRM, Stoddart Group, Lysaght, Stratco, VM Zinc and Kingspan were also nominated. There are clearly numerous companies in the industry who are considered innovative or progressive.

Sustainable housing – important or simply a compliance requirement?

Is sustainable housing important to our respondents? The overwhelming answer is yes, with 52% considering sustainability to be ‘Very important’ and 35% considering it to be ‘Somewhat important’. 10% of respondents felt that it was only important where there were compliance requirements (such as BASIX, NABERS or NatHERS), while a small number of respondents (3%) didn’t think sustainable housing was important at all.

In terms of building a sustainable home, 91% of respondents thought that roof ventilation was an important factor, while a small number of respondents (9% in total) thought it was ‘Neither here nor there’, or not important at all.

The effectiveness of rating tools

Respondents were asked how effective they thought BASIX/NABERS/NatHERS were at influencing building practice in the right ways to build more sustainable houses. The majority of respondents (43%) felt that these tools were ‘Somewhat effective’, while 23% considered them ‘Very effective’. 13% of respondents didn’t believe these tools were effective at all, indicating that there is some progress to be made in terms of increasing their effectiveness in influencing sustainable building practices.

Changes to ventilation requirements

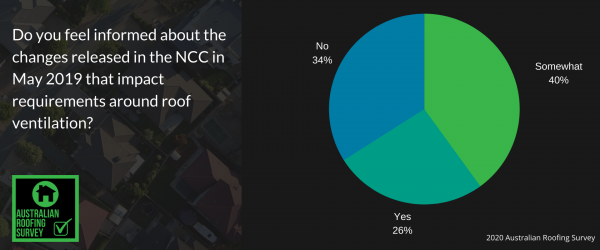

In May 2019, changes were made to the National Construction Code (NCC) in relation to roof ventilation. The changes include requirements for water control membranes, permeable membranes, the ventilation of roof spaces and the discharge of exhaust systems from kitchens, bathrooms, toilets or laundries.

40% of respondents knew about the change, but not the specifics of the change, while 26% were fully aware of the new requirements. 34% of respondents weren’t aware of the changes at all.

Respondents were also asked how effective they thought breathable underlays were at reducing condensation build up in roofs. 56% of respondents considered them ‘Somewhat effective’, while 32% thought they were ‘Very effective’. A smaller number (6%) didn’t consider them effective at all.

Thanks again to those who participated in the survey. We’ll continue to keep you updated on the issues we feel are important to you. In the meantime, if you’d like more information on anything you’ve read, please email info@evobuild.com.au.