The results of our 2022 Australian Roofing Survey are in!

As always, these findings provide an interesting insight into the trends currently prevalent within the industry regarding demographics, materials, and challenges. However, we also wanted to give our respondents a chance to offer their thoughts on issues affecting the industry that are more personal.

With that being said, let’s see what our community had to say.

Who took part in the survey?

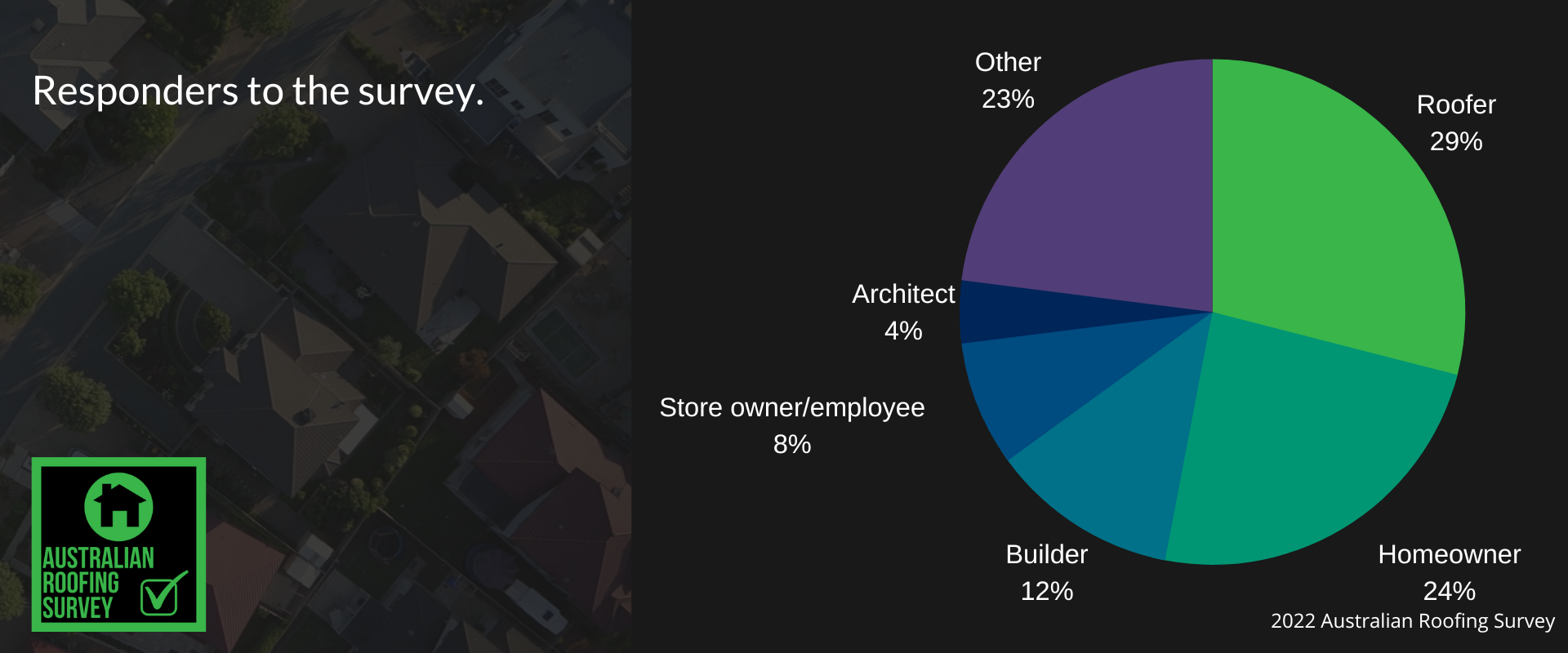

As always, our respondents came from a variety of backgrounds, with roofers (29%), homeowners (24%), and builders (12%) making up the top three. Gaining perspectives from those involved in all aspects of the roofing industry, from construction to supplying, remains an important feature of our survey and allows us to gain a broad overview of the entire sector.

As with previous years, the majority of our respondents were based in New South Wales (49%) and Victoria (24%). All other states and territories are represented as part of our results.

There was also consistency with last year’s results in relation to our respondents’ service length, with 45% stating that they have been in the industry for over twenty years and 27% stating that they have been involved for less than five years. This is an indication of the robust nature of the sector, with so many individuals working through and adapting to the changes in the industry.

How is the roofing industry looking?

There are potential signs that the industry, in line with many others, has been affected by the fluctuating and unpredictable job market that is still recovering from the pandemic. When asked if they employed more or fewer people than twelve months ago, 74% said fewer.

There is a high likelihood that this is linked to the rising price of materials, which 28% of respondents stated was the biggest challenge facing their businesses over the last twelve months. However, this was only the second-highest response, with 30% stating that finding labour was a bigger challenge.

This may indicate the need for a big push in recruitment and making the roofing industry appealing to young workers. Without this, the industry may struggle to replace those long-serving roofers as they approach retirement age.

Roofing materials and projects

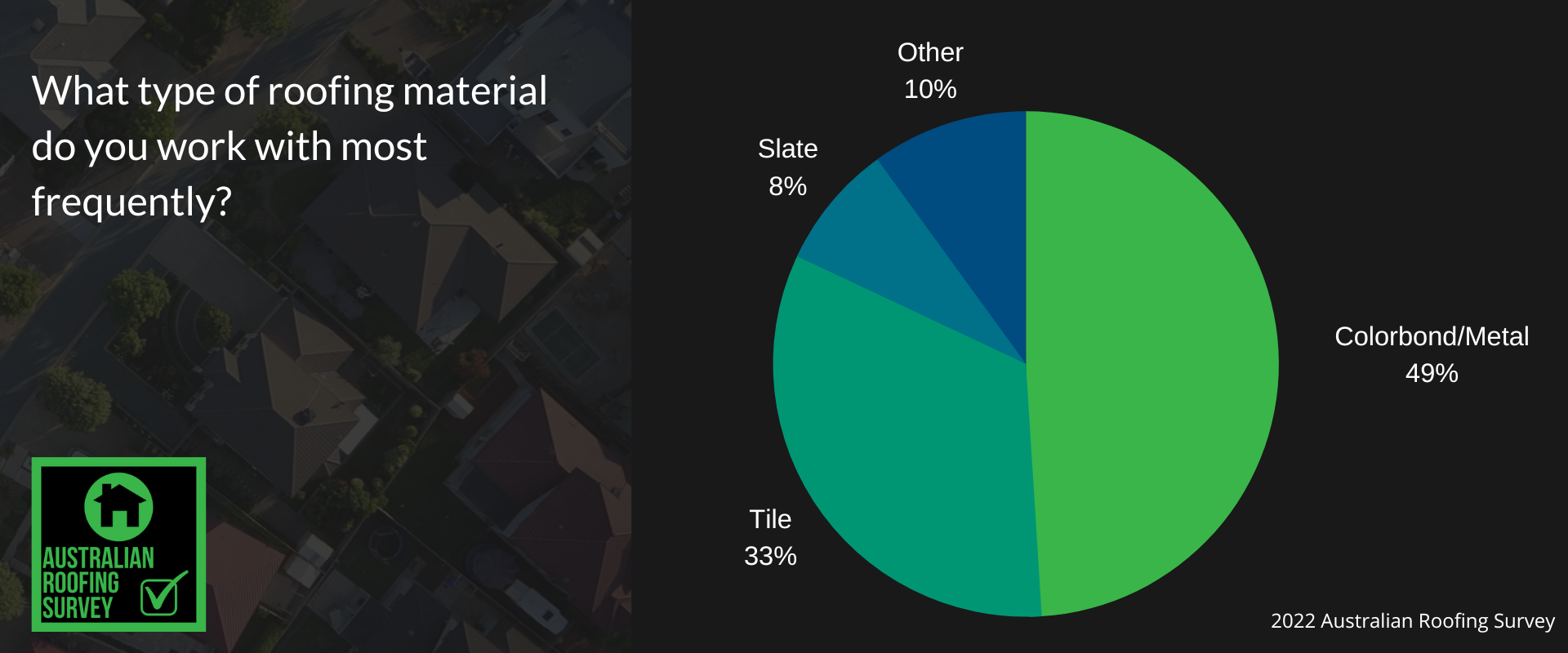

In terms of roofing materials used, the responses remain similar to those of 2021. Colorbond/metal roofs were the most common materials (49%), with the terracotta/ceramic/concrete group also scoring high (33%).

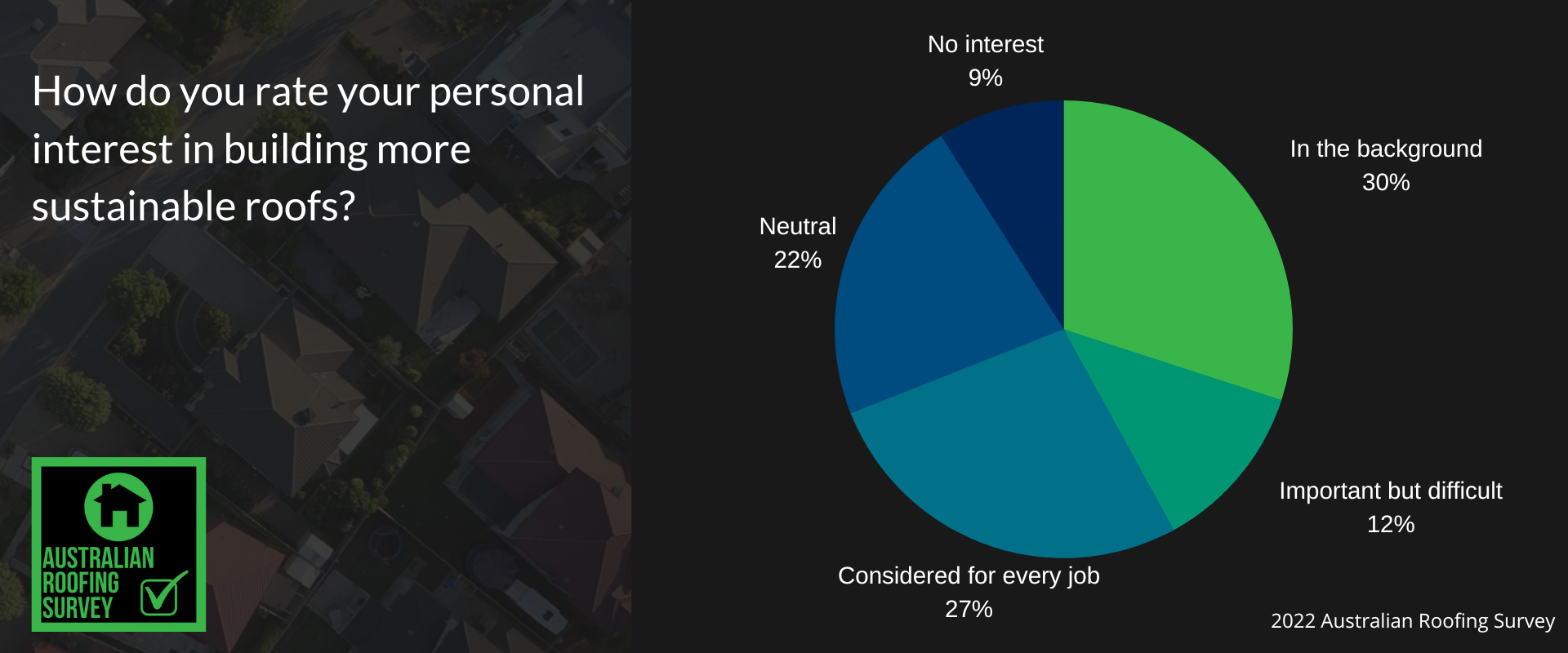

There does not appear to have been much movement toward using more eco-friendly materials, such as solar tiles or sustainable (green) materials, which may be disappointing to some. This correlates with the fact that only 12% of respondents stated that building sustainable roofing was an important part of the job but that it was challenging to implement the opportunity to do so. However, on a more positive note, 27% of respondents stated that sustainability was an essential consideration for all projects.

When it comes to preferred manufacturers, CSR Monier (15%) and Bristile (12%) were the two most commonly cited brands, though the vast majority of respondents (61%) didn’t state a specific manufacturer.

In terms of the nature of roofing projects, renovations (41%) were the most common type of project, with new builds (27%) second.

Attitudes and challenges

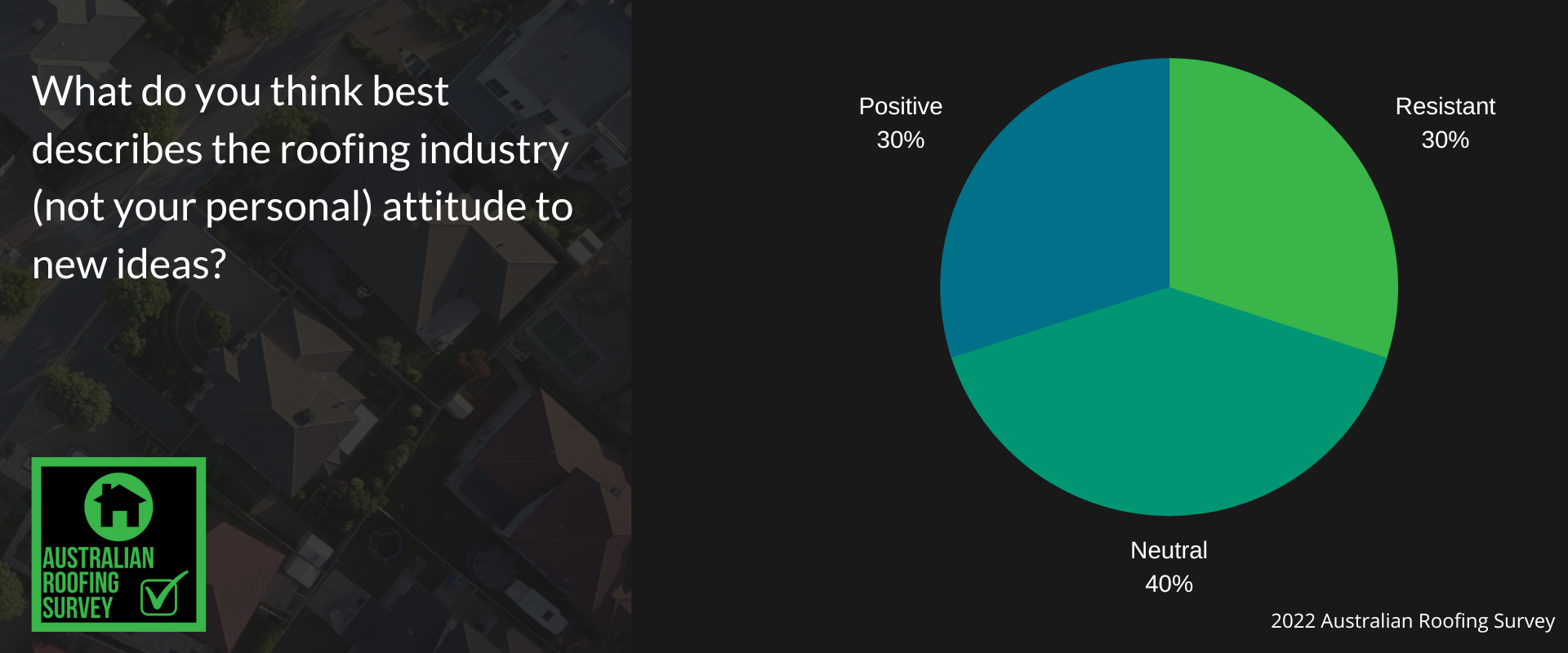

When asked about the roofing industry’s overall attitude to implementing new ideas, the response was evenly split, with 30% of respondents stating that the industry was positive toward new ideas.

However, the same percentage stated that the industry was still resistant. This lines up with findings from last year’s survey that indicated a reluctance to adopt new ideas from overseas, such as dry ridging.

As part of this year’s survey, we also included two open-ended questions for our respondents to consider. Two broad areas dominated the responses when asked what the most significant challenges to the industry will be over the next five years

The first was concern over both the supply and cost of new materials. The second was a concern over training for new labour, and, in particular, “a lack of interest from young people” and “no prospects for professional development beyond an apprenticeship.” This correlates with previous answers gathered in this survey.

Respondents were also asked for their opinion on the impact the government’s commitment to reducing carbon emissions will have on the future of roofing materials. One respondent stated that a “need to investigate and trial new products” was something that needed to be looked at. However, the majority of responses centred around the need to “integrate solar panels into slate and tile roofs.”

One respondent also suggested that these government policies were “causing increased costs of steel production and delivery costs.”

This would indicate that while many in the industry support the use of more sustainable materials and construction, current supply costs make this difficult to achieve.

Have Any Questions

As always, we want to thank all of you who took part in the 2020 survey. We always find this activity insightful and hope that our readers will also take something useful from it. If you have any questions or comments, please don’t hesitate to email us at info@evobuild.com.au.